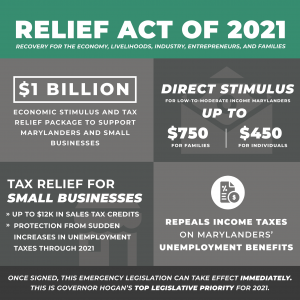

OCEAN CITY – Gov. Larry Hogan announced on Monday a comprehensive $1 billion COVID-19 relief package that will directly benefit hundreds of thousands of Marylanders and small businesses if approved by the state legislature.

The emergency Recovery for the Economy, Livelihoods, Entrepreneurs and Families, or RELEF ACT of 2021, introduced by Hogan would include direct stimulus payments to about 400,000 Marylanders totaling $750 for families and $450 for individuals with low- to moderate income levels. The direct relief payments would be available to those who qualify for the Earned Income Tax Credit.

The RELIEF Act of 2021 would also repeal state and local tax on unemployment benefits. The proposed relief package would also provide $300 million in sales tax credits for small business. Eligible small businesses could see relief from sales tax at $3,000 per month for four months, or a total of $12,000. About 55,0000 small businesses in Maryland would benefit from the relief package.

‘This pandemic has caused tremendous struggles for Marylanders,” said Hogan. “The primary focus of the 2021 General Assembly session is to provide immediate relief for families and small businesses. I’ve directed our team to explore every possible avenue as we face unprecedented economic hardship.”

Hogan said Maryland’s proposed COVID relief package in intended to supplement federal stimulus packages for families and small businesses struggling to stay afloat in the midst of the pandemic. He urged state lawmakers to act quickly on the relief package when the General Assembly session opens on Wednesday.

“This is targeted direct relief to fill in the gaps,” he said. “I’m asking the legislative branch to assist by immediately passing this relief package. I can’t imagine anything more important. Struggling Maryland businesses and families cannot afford the partisan bickering seen in Washington.”

Hogan will introduce the RELIEF Act of 2021 as emergency legislation when the session opens on Wednesday and urged his colleagues in the state Senate and House not to drag their feet on passing the legislation.

“The events of the past 10 months have wreaked havoc on the nation’s economy and Maryland has not been immune,” he said. “Maryland’s economy has been resilient, but still many are struggling and in need of relief.”