BERLIN – After hours of discussion and four failed votes, Berlin’s elected officials approved a one-and-a-half cent tax increase this week.

On Monday, the Berlin Town Council voted 4-1 to approve a tax rate of $.815 per $100 of assessed property valuation The decision, which will equate to a $45 increase for someone with a home assessed at $300,000, came after the town’s department heads said the flat $.80 rate Mayor Zack Tyndall proposed would not fund the town’s needs.

“This balanced budget you’re seeing tonight that’s entailed with an 80-cent tax rate is balanced on the backs of the employees,” Planning Director Dave Engelhart said.

Tyndall opened Monday’s public hearing on the tax rate with comments on his draft general fund budget. Though the proposed spending plan featured a deficit of $130,000 when he initially introduced the rate of $.80 per $100 of assessed value in early March, Tyndall said he’d spent the past two weeks balancing the $6.7 million budget.

“In the current draft you will see we no longer have a projected deficit and in fact have a little less than $100,000 in a contingency fund,” he said.

Tyndall added that the budget included funds for a new street sweeper, electrical access for town events, new tree lighting on Main Street, a feasibility study for a community center on Flower Street, phase one of a Rails to Trails program and a strategic plan.

“This plan will be a community centered document that will help guide Berlin in the upcoming years,” he said. “I remain confident that my proposal of 80 cents per $100 of assessed value tax rate is the best path forward for FY22.”

Resident Marie Velong said she supported Tyndall’s proposed rate, particularly considering the pandemic.

“I think everyone has been through some type of hardship this last year,” she said.

Town Administrator Jeff Fleetwood told council members they should look at both budgets they’d been provided. He said the one that had featured a $130,000 deficit had included department head input while the most recent budget draft had been adjusted by Tyndall. He suggested council members look at how the balanced budget had been achieved. Fleetwood also encouraged officials to listen to input from leaders of each of the town’s departments.

“They are professionals in what they do so listen to them please…,” he said, acknowledging that setting the tax rate was a monumental decision. “When you make your decision, whatever that may be, we’re going to make that work. I can promise you that. But it’s a decision you’ve got to make.”

Velong stressed the importance of the town’s citizens, who elected the officials who hired town staff.

“You have to remember it’s the citizens who are the most important in this whole process,” she said.

Resident Carol Rose said she felt the town’s staff did have the best interests of the town’s citizens in mind. She asked Tyndall what he’d cut from the initially proposed budget.

“I think some of the citizens don’t know exactly what’s in the budget,” she said.

Tyndall said he had eliminated salary increases for employees.

“A portion of that did help close that gap of $130,000,” he said.

Resident Jim Meckley pointed out that taxes had been a campaign issue last fall. He thanked Tyndall for proposing a flat rate.

“We saw the results of the election, I think it spoke very clearly we were not in favor of a tax increase,” he said.

He added that while he felt bad for town employees, they had likely received the federal stimulus funds most Americans had.

Councilman Jay Knerr asked to hear from the town’s department heads. Ivy Wells, the town’s economic and community development director, said she was in a precarious position because she was a Berlin resident who was concerned about the tax rate but was also tasked with running a town department.

“There are things I need in my budget that are not there any longer,” she said.

She added that she could have made changes to her initially proposed budget if asked.

“If it was left up to us to make our own adjustments I think we probably could have worked some things out,” she said. “Instead we were told what we had to cut.”

Police Chief Arnold Downing said this was the 22nd town budget he’d worked on.

“We’ve actually had harder times in this town than this,” he said, adding that the town was doing well compared to some places.

Downing said that time and time again, elected officials recognized town employees for their efforts.

“Making statements are one thing,” he said. “Being in front of cameras are another. But to go ahead and really truly show the support when it’s time to go ahead and lay it on the line, that’s when it really matters.”

According to Downing, six of the last eight officers he’s hired have taken pay cuts to come to Berlin. They left other municipalities in some cases because they didn’t feel the support of the town council, he maintained.

“I guaranteed them I would fight for them,” he said.

Like Wells, he believes he could have made changes to his department’s budget if asked. Instead, he said one person – the mayor — had made line item cuts.

“Tell me who better than me can tell you what I need in a budget?” he said. “You can’t arbitrarily say ‘I think this is not necessary’ and not even understand what that line means. You have to truly understand these lines.”

Deputy Town Administrator Mary Bohlen, a 30-year Berlin employee, said the municipality had low turnover.

“The employees have always felt needed and wanted and respected,” she said. “The types of cuts that are proposed in this budget will take away that feeling of need and want and respect in one pen stroke.”

Kelsey Jenson, administrative manager, pointed out that while employees had received a 2% cost of living adjustment last year — after two years of no increase — that adjustment hadn’t resulted in an increase in net pay because of increasing healthcare costs.

Knerr said he had concerns with the way the budget had been developed simply to meet the 80-cent tax rate.

“Nothing destroys morale more than when you cut employee benefits,” he said. “It simply is wrong, and it shouldn’t be done.”

He added that some of the revenue items in the budget, such as grants from the county, weren’t guaranteed.

Councilman Jack Orris agreed that the council was in the middle of a guessing game.

“I understand the process but in my opinion this process is flawed,” he said.

Tyndall defended his proposed budget and the cuts he’d made after hours of research.

“It’s not done with the stroke of a pen,” he said. “It’s done with hours of research, it’s done with consultation with every single department head.”

He said he asked employees to explain their budgets and how each item was tied to a service provided to the town. He said the only items he’d removed were salary increases, some vehicle allowances and some cell phone allowances. He said all general fund employees currently received a cell phone allowance even if they worked behind a work station.

“I disagree with that fundamentally,” he said.

He added that he’d also determined that some capital requests could be delayed.

“Is it hard for me to tell our employees no? Most definitely,” he said. “I have to look them in the eye every single day.”

Tyndall said he’d provided the council with a draft of the budget last week even though when he was a council member he’d never received a copy of the budget before he voted on the tax rate.

“I don’t squash a difference of opinion,” he said. “If somebody disagrees with me—every single department head in here has said they disagree with what I’m doing. And that’s ok. I don’t hold a grudge. We disagree on something and we can have debate on that issue. That’s all I’m asking for this evening.”

Councilman Dean Burrell said he understood that comment.

“But in a negotiation or a conversation there are usually two points of view and if I’m not receptive enough to consider someone else’s point of view, what good is talking?” he said. “What has been described here seems like the meetings with the department heads, the only point of view that was considered was yours. I don’t think that’s right.”

Tyndall said he had a duty to follow town code and present a balanced budget.

“I have to take into consideration that there are just about 5,000 people that call the town of Berlin home,” he said. “They have to be able to pay the tax rate we set.”

Knerr said Tyndall had never reached out to the council.

“That in itself make it a dysfunctional process,” he said. “You need to be more inclusive.”

Tyndall argued he’d been following the budget work schedule that had been shared months ago.

“I go above and beyond to make sure the council is informed,” he said.

Knerr said everyone wanted the town to move forward.

“But I think we also want to work with you and help you make decisions,” he said. “This is a very important one. Please utilize the wisdom and years of experience of the council. We can help you in this process.”

Councilwoman Shaneka Nichols said she was concerned about the town delaying spending on things that might be needed. She questioned cuts to training programs.

“I can’t in good faith at a time I’m saying we don’t have funding to fund salary increases, I can’t say I’m going to support funding a national conference,” Tyndall replied.

Nichols said she wanted healthy conversation on the budget so Berlin could maintain its quality of life.

“If we don’t address how we move forward with this budget, or how we move forward with this tax rate, how are we going to fix anything?” she said. “How do we maintain the level of comfort that this town as a whole has gotten accustomed to if we don’t address this right here? It’s not necessarily about politics it’s about what do we do to maintain and keep this town functioning at the same level that we’re on right now.”

Councilman Troy Purnell pointed to past history. He said the town should have raised taxes incrementally and instead cut the tax rate a few years ago. He added that road improvements weren’t even considered in the proposed budget. Looking at that and the town’s other expenses—and the fact that officials just approved a new reserve policy—Purnell said the town really needed a nine-cent tax increase.

“Politically, it’s probably suicide,” he said. “But it’s what needs to happen.”

He said if the rate had been raised to 88-cents two years ago, the town wouldn’t be in this position.

According to staff, a rate of $.815 would generate an extra $69,581 while a rate of $.82 would generate an extra $92,775 and a tax rate of $.83 would generate an extra $139,162.

Tyndall pointed out that if the council wanted to fully fund the department heads’ proposed budget the rate would have to go to $.83. A $.83 rate would mean an additional $90 a year for someone with a home assessed at $300,000.

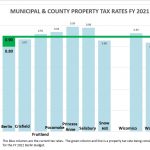

When asked about tax rates in neighboring jurisdictions, staff said the rate in Pocomoke was $.9375, the rate in Snow Hill was $.86 and the rate in Ocean City was $.4559.

Finance Director Natalie Saleh encouraged officials to consider the future and the town’s need to continue providing services.

“The tax rate is a mechanism to operate the general fund and provide uninterrupted services,” she said.

Burrell said he felt the budget as Tyndall presented put the town at jeopardy.

“When you impact on staffing that impacts on services and needless to say the quality of services,” he said.

Though the possibility of delaying a decision on the tax rate was brought up, Tyndall said his recommendation to keep the rate flat would not change.

“At 80 cents we’re going backward,” Purnell said.

Knerr, citing a comment from Velong regarding the number of citizens who relied on a fixed income, said he thought any increase should be eased into. He made a motion to set the rate at $.815 but received no second.

Colin Zimmerman, government affairs director for the Coastal Association of REALTORS, said he supported Tyndall’s tax rate and asked the council to plan any increase in a stepped fashion in consideration of residents.

“That may give the people of Berlin a way to plan for it in their own budgets,” he said.

Purnell said costs increased every year and made a motion to set the tax rate at $.86. The motion received no second and Burrell went on to make a motion to set the rate at $.83. When that motion failed to get a second, Orris suggested postponing a decision.

“As chief executive of the administrative arm it’s very difficult for us to progress further in this process without some sense of revenue understanding…,” Tyndall said. “By postponing this you’re not going to make it any easier.”

Saleh agreed that delaying would stall the budget process since property taxes were the primary source of revenue for the general fund. She added that the council should consider unexpected expenditures such as infrastructure or vehicle failures.

“What if something happens unpredictable through the budget year?” she said. “We don’t have a healthy financial stability going forward three years in the future.”

Velong said she agreed with Tyndall’s budget rollbacks.

“This is a small town,” she said. “It’s not a major city like Ocean City or Salisbury.”

She added that training conferences like those Tyndall had cut were just a way for employees to “get to go someplace and have a good time on the city’s money.” She added that Knerr’s proposed $.815 rate was a compromise.

“If you’re going to do anything, the distance you have to go is 83 cents,” Tyndall said. “Much less than that, you’re going in the wind.”

Burrell asked if that was the case why hadn’t Tyndall proposed that rate.

“Because I saw a path forward that didn’t involve raising taxes,” Tyndall said. “I understand how hard economic impacts are on our community.”

Burrell said based on his 83-cent comment Tyndall should have proposed that rate.

“We’re sitting here playing politics,” Burrell said. “We’re sitting here playing politics with the future of our town and the wellbeing of our town.”

Tyndall maintained his recommendation was for an 80-cent rate and that it would not jeopardize services.

“If that is your vision your vision is flawed,” Burrell said.

Tyndall replied that his tax rate recommendation came after hours of consultation with department heads.

“I’m sorry but my professional opinion was 83 cents in all the discussions,” Saleh added, stressing that she wasn’t thinking about raises or benefits but rather the town’s resilience. “The bypass on 80 cents, it’s scrambling.”

Fleetwood said he agreed. Purnell echoed that.

“We can be the cheapest or we can be the best,” Purnell said.

A motion from Nichols for $.83 cents failed with just two votes. A subsequent motion to approve a $.815 rate passed 4-1, with Purnell opposed because he wanted a larger tax increase to help the town.