BERLIN — When property owners across much of the Lower Shore get their property reassessment notices in the mail this week, most will find their values have increased since the last reassessment three years ago and some more so than others.

The State Department of Assessment and Taxation (SDAT) on Tuesday announced the results of the triennial assessment of residential and commercial real estate values across Maryland and the news was particularly good statewide with an average increase of around 9%. On the Lower Shore, properties in Worcester County’s Group 2 reassessment area lagged behind the state average, coming in at a combined 4.7%, while Wicomico far exceeded the statewide average increase, coming in at a combined 11%.

Each year, about one third of the residential and commercial properties across the state are reassessed and assigned new values that are used to determine property tax amounts. This year, properties in the Group 2 areas were reassessed as part of a rotating system in which the entire state is not reassessed in a single year. The Group 2 properties were last reassessed in 2017 and the new assessments announced this week represent the values as of Jan. 1, 2020.

Statewide, residential properties in Group 2 areas saw their values increased by an average of 9%, or just about the same increase realized during the last reassessment three years ago. Residential properties in Maryland saw their values increase by an average of 7%, while commercial properties saw their values increase by an average of over 13%.

“All 23 counties and Baltimore City experienced an increase in residential and commercial properties for the second consecutive year, which is a good indicator the market remains strong and growth is steady,” said SDAT Director Michael Higgs. “I want to thank all of the Department’s real property assessors throughout Maryland for the hard work and dedication they have displayed this year to ensure that Maryland’s properties continue to be assessed fairly and uniformly. As part of our Tax Credit Awareness Campaign, each reassessment notice includes information about the Homeowners’ and Homestead Tax Credits, which save Marylanders more than $260 million in taxes each year.”

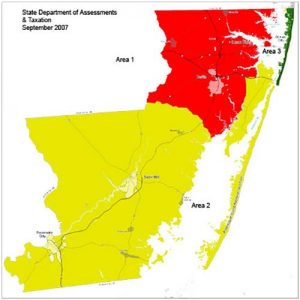

Like all other counties in Maryland, Worcester is divided into three assessment areas with residential and commercial properties reassessed every three years. This year, Group 2 was reassessed in Worcester. Group 2 includes much of the south end of the county including Snow Hill, Pocomoke, Girdletree and Stockton, for example.

However, Group 2 also includes vast areas of West Ocean City and down the Route 611 corridor to South Point. The assessment groups in Worcester are divided as evenly as possible with Group 1 including Berlin, Ocean Pines and much of the north end of the county and Group 3 representing all of Ocean City as a stand-alone area because the density and number of property accounts in the resort.

In the latest reassessment released this week, Worcester’s Group 2 did see an overall increase from the last reassessment in 2017, but lagged behind the statewide average. In Worcester, the total number of residential properties reassessed saw their values increase from $2.2 billion in 2017 to $2.3 billion in 2020, representing an increase of 4.4%, or about half of the statewide average of 9%.

The value of commercial properties in Worcester’s reassessment area went from $589 million in 2017 to $624 million in 2020, representing an increase of 6%, which still lagged behind the statewide average. Combined, Worcester’s residential and commercial property value increased from $2.8 billion to $2.9 billion, representing an overall increase of 4.7%. Nonetheless, property values in Worcester’s Group 2 reassessment area increased by around $1 billion, which should bode well for the county in terms of property tax revenue increases at budget time.

Over in Wicomico County, properties in the Group 2 reassessment areas saw their values increase by a combined 11%, second in the state only to Montgomery County, which saw its values increase by 13%. Wicomico County was one of only three counties statewide to see their values increase by double-digits.

In Wicomico, the double-digit overall increase was driven largely by gains on the commercial side. Residential property values in Wicomico increased from $1.7 billion to $1.8 billion, representing an increase of 6.3%. However, commercial property values increased from $791 million to $963 million, representing an increase of 21.7%. The 21.7% percent gain in commercial property values in Wicomico was by far the largest gain in the state. The next closest was Anne Arundel County, which saw its commercial property values increase by 17%.