OCEAN CITY — Resort tourism officials this week debated the potential impact on one of the fastest growing platforms for connecting visitors with rentals in Ocean City, and while the law appears clear on the mandatory collection of sales and room tax, finding out just how many are using it continues to present challenges.

The Tourism Committee on Monday met with Ocean City Hotel-Motel-Restaurant Association (OCHMRA) officials and real estate industry representatives in an attempt to gain a better understanding on Airbnb and similar companies that provide an online platform for connecting visitors to accommodations in the resort. Airbnb enables property owners to rent homes, apartments and even single rooms to visitors searching online for accommodations by bypassing the traditional rental companies.

Founded in San Francisco in 2008, it is hardly a new concept and allows Internet-savvy visitors to pick and choose accommodations and a price that fits their budget with the click of an app, which connects them to property owners.

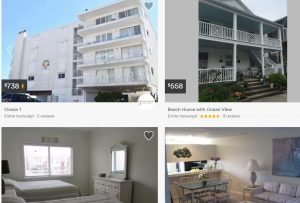

A check of the Airbnb website on Wednesday revealed 300 properties currently listed in the resort from lavish beachfront condos to an RV parked about a block from the bay. The site lists the average nightly rate at $270, and a check for the availability on Wednesday night revealed everything from a four-bedroom, single-family home in the ocean block for $400 to a pop-up camper near the bay for $76.

Just like Uber has changed the transportation industry, Airbnb is making remarkable inroads on the traditional vacation rental industry and has become a multi-billion dollar business with millions of available accommodations in thousands of cities and countries across the U.S. and worldwide. The property owners pay Airbnb and similar companies a percentage of the rent collected to list their homes, while the renters often pay a larger percentage to the company for providing the service.

In essence, Airbnb gets them coming and going, and the convenience and selection has turned it into a major industry. While it has been around for nearly a decade, the impact of Airbnb and similar companies has started to make its presence felt in the resort, according to OCHMRA Executive Director Susan Jones.

“It certainly has become very popular,” she said. “It’s larger than some major hotel companies. The guests pay 9 to 12 percent depending on the listing and the host pays another 3 percent.”

Councilmember and Tourism Committee Chair Mary Knight listened attentively to the financial details outlined for Airbnb, but said the numbers were missing one key element essential to the discussion in regards to the potential impact on Ocean City.

“Nowhere in all of those figures do I hear the word room tax,” she said.

That is a major concern in a resort town that earns its living in the hospitality industry and whose budget relies heavily on room taxes. Worcester County collected over $13 million in room tax last year, largely derived from Ocean City, but that figure could take a substantial hit if Airbnb and similar companies come in and take a sizable portion of the rental market without collecting the requisite sales and room taxes.

“What concerns us is there are 25,000 condo units in Ocean City, so there is real potential for Airbnb to come on and exploit that market,” she said. “Hotels in New York have seen a significant decrease in demand and they are laying off workers in some cases. The hotel community is very concerned, but it’s here to stay and we have to have a level playing field.”

New York City recently took action against Airbnb, passing legislation that makes Airbnb illegal because it violates the New York State Multiple Dwelling Law, which prohibits unhosted rentals of less than 30 days. Gov. Andrew Cuomo has not signed the bill yet, however.

Concerning to local officials is the rather nebulous profile for Airbnb, which has been difficult to pin down. According to Jones, the website lists an email address and she and her staff have met with an Airbnb representative in person, but the company is largely unresponsive to efforts to reach it.

“Our auditor is trying to find them, but there is no way other than email and they don’t respond,” she said. “When the Airbnb lobbyist was in my office, he said they were happy to collect taxes and they wanted to play fair, but when I tried to contact him they said he was on vacation and I haven’t heard from him since.”

While an effort has been made to pin down Airbnb on the room and sales tax issue, Mayor Rick Meehan pointed out the bottom line is any property rented in Ocean City is required to have a rental license and the property owner is responsible for ensuring the requisite sales and room tax is paid regardless of the platform from which it is offered.

“It is the responsibility in Ocean City of the property owner to have a rental license and remit sales tax and room tax,” he said. “The property owner is obligated to pay that legally. If a property owner wants to rent less than six months, they have to get a rental license and pay the room and sales tax whether they rent to their mom and dad, uncle, brother or whomever.”

Meehan said the challenge is finding out just how many are using Airbnb and similar companies to list their properties.

“That’s the thing we have to be aware of,” he said. “There is a $500 fine for renting without a license, and we try to follow up, but there is just no fail safe way to determine just how many are doing it. They don’t give the address and unit number when they list it. The only way to find out is to make a reservation.”

Jones said Anne Arundel County Senator John Astle introduced a bill in the 2016 session that would have regulated Airbnb in Maryland somewhat but it failed to make it out of committee. She said the OCHMRA did not get behind the legislation because it did not fully understand the issues when it was filed, but she expected similar legislation to reappear in the next session.

The bill would have required hosting platforms that offer limited residential lodging in the state to register with the Comptroller’s Office to collect and remit on behalf of the lodging operators the state sales and use tax and requisite room tax. The bill would have also established rules and procedures that relate to the collection and remittance of the specified taxes.

Meehan pointed out Ocean City is diligent about tracking who is renting and who has or has not acquired a rental license, but ultimately the room tax is collected by Worcester County and then redistributed.

“The room tax is collected by the county, but they don’t really track it,” he said. “They are not going to go out and see if a property owner is using Airbnb or any of these companies.”

Tourism Committee member Todd Ferrante said many weren’t aware of the rental license requirement and some would rather run the risk of getting caught without one in order to use Airbnb.

“The consequences have to be harsher than the tax,” he said. “I don’t know if a lot of people are aware of it. Many probably don’t know they are not supposed to rent without a license and without paying the taxes.”

Coastal Association of Realtors Government Affairs Chair Joe Wilson agreed the hammer had to be bigger to ensure sales and room tax were being paid.

“They’re business people,” he said. “You have to hit them in the wallet. If the penalty isn’t worse than the cost of the license, they’re just going to avoid it and take their chances. If Airbnb can collect it and remit it, there might be a better solution. I’m not sure how you do that without legislation.”

Planning and Community Development Director Bill Neville said the current review of the town’s comprehensive plan includes a chapter on housing and in that section is a plan to inventory the number of hotel rooms.

“That’s where we need to build the case,” he said. “We need more clear definitions of the types of rentals and define what fees are required and what the impact is of the shorter-term rentals.”

Neville said Airbnb and similar companies are making inroads in the resort’s rental industry, but needed to be carefully monitored.

“Airbnb is filling in this very small micro-market and that’s something Ocean City needs to be aware of,” he said. “If the current taxation mechanism doesn’t work, we might have to consider building it into the rental license fee somehow because there is no other way to track it. It’s not easy to deal with on the street. You think you have it solved and next week another challenge arises.”